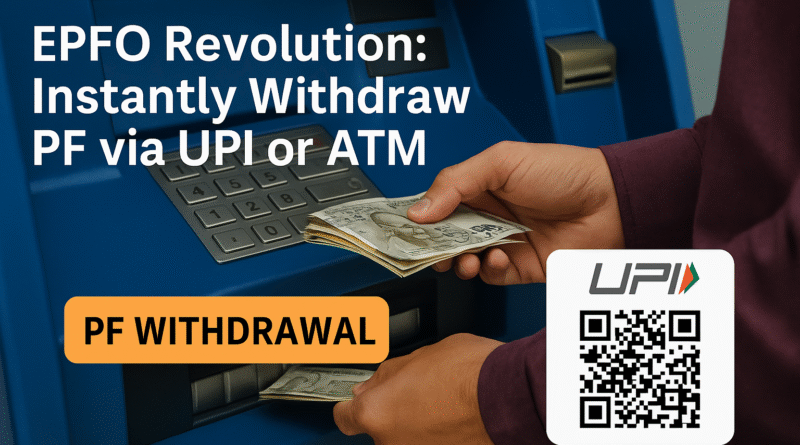

EPFO Revolution 2025: Instantly Withdraw PF via UPI or ATM – Complete Guide

EPFO Revolution: Instantly Withdraw PF via UPI or ATM | New 2025 Update

EPFO introduces instant PF withdrawal through UPI and ATM. Learn how to access your provident fund in seconds without long waits or paperwork. Latest 2025 update!

EPFO now enables instant PF withdrawals using UPI apps and ATMs. Learn the step-by-step process, eligibility, KYC, benefits, and security behind this 2025 game-changer.

The Employees’ Provident Fund Organisation (EPFO) has taken a massive digital leap in 2025 by enabling instant PF withdrawals through UPI apps and ATMs. This revolutionary update empowers millions of employees to access their retirement funds within seconds—anytime, anywhere—without paperwork or delays.

EPFO Revolution: Instantly Withdraw PF via UPI or ATM

In a landmark move set to empower millions of Indian employees, the Employees’ Provident Fund Organisation (EPFO) has rolled out a revolutionary update – instant PF withdrawals using UPI or ATM. This digital leap is a major shift from the traditional system that required long processing times and paperwork.

🏦 What Is EPFO’s New Instant PF Withdrawal System?

EPFO, in collaboration with NPCI (National Payments Corporation of India) and RBI-regulated banks, has introduced real-time PF disbursement via:

- Unified Payments Interface (UPI)

- ATM-enabled withdrawals using UAN-linked bank accounts

This system removes the need to wait for 3–10 working days, which was the standard processing time earlier.

⚙️ How Does It Work? – Step-by-Step Process

✅ For UPI-Based Withdrawal:

- Update your KYC on the UAN portal.

- Open any UPI-enabled app (PhonePe, Paytm, GPay).

- Go to “EPFO Services” (under Bill/Pay sections).

- Enter your UAN number and verify via OTP sent to your registered mobile.

- Select claim type: Partial/Full withdrawal.

- Choose amount → Confirm → Get funds instantly to your linked bank.

✅ For ATM-Based Withdrawal:

- Visit a participating bank ATM integrated with EPFO’s system.

- Insert your bank ATM card that is linked to your EPF account.

- Select the PF Withdrawal option on the screen.

- Enter your UAN and OTP for verification.

- Select the amount and withdraw instantly.

What’s New in 2025?

EPFO is integrating with UPI networks and banking systems to provide real-time access to your provident fund balance. This means employees can now:

- Withdraw funds instantly via UPI apps like PhonePe, Paytm, Google Pay, and BHIM.

- Use ATM cards linked with their UAN account for seamless cash withdrawal.

Key Benefits of the New System:

✅ No More Waiting: PF withdrawals that once took 3–10 days can now be done in seconds.

✅ 24/7 Access: Withdraw anytime – weekends, holidays, emergencies.

✅ Zero Paperwork: Forget physical forms or employer signatures.

✅ Increased Transparency: Real-time tracking through UAN portal or EPFO app.

Why This Matters

This reform is especially important for:

- Workers in urgent need of medical or educational funds.

- Employees in remote areas with limited access to EPFO offices.

- Tech-savvy youth who demand instant services.

The EPFO’s collaboration with NPCI (National Payments Corporation of India) ensures high-level security and smooth integration with the country’s digital finance backbone.

This update is a historic step towards digitizing India’s financial and retirement systems. With instant UPI and ATM access, PF funds become more flexible, accessible, and reliable than ever before.

Stay tuned for more updates, and make sure your UAN account is KYC-compliant to enjoy these benefits without delay!

📋 Eligibility Criteria

To access instant PF withdrawal:

- Your UAN must be active and Aadhaar-seeded.

- Bank account and PAN must be updated in your EPFO profile.

- UAN must be KYC-verified.

- Minimum service duration of 6 months (for partial withdrawal).

- Sufficient PF balance available.

🔐 Security Features

- OTP-based verification at each step.

- End-to-end encrypted transactions (NPCI UPI framework).

- Instant SMS alerts on registered number.

- Integrated fraud detection system in collaboration with UIDAI.

💼 Use Cases of Instant PF Withdrawal

1. Medical Emergency

No need to wait days for disbursement during a family health crisis.

2. Job Loss or Resignation

Access funds immediately after leaving a job to manage expenses.

3. Education & Marriage

Withdraw partial PF amounts for your or your child’s education/marriage.

4. Home Loan Repayment or Renovation

Claim funds to cover home-related expenses as allowed under EPFO norms.

🔮 What This Means for India’s Workforce

- Empowers gig workers, small-town employees, and salaried class with quick access to their retirement savings.

- Promotes financial independence during tough situations.

- Supports Digital India & paperless governance initiatives.

- Boosts trust and transparency in EPFO operations.

📣 Official Sources and Rollout

- The pilot rollout has begun in tier-1 and metro cities with major banks like SBI, HDFC, ICICI, and Axis.

- Full India rollout expected by Q4 2025.

- EPFO app will soon feature in-built UPI withdrawal options.

✅ Tips for Users

- Keep your UAN KYC always updated.

- Link your Aadhaar, PAN, and bank account correctly.

- Never share UAN or OTP with unknown sources.

- Use EPFO’s official app or UPI-integrated apps only.

The EPFO instant PF withdrawal facility via UPI and ATM is a landmark reform that transforms how Indian employees manage their retirement savings. No longer limited by paperwork or processing delays, users can now access their funds in seconds—a huge win for financial empowerment and digital India.