How to Create a Budget and Save Money: A Step-by-Step Guide for 2025

Are you tired of living paycheck to paycheck or unsure how to manage your finances effectively? Creating a budget is the cornerstone of financial success, especially in 2025 with rising costs in the USA and Canada. This detailed guide will teach you how to create a budget, share practical budgeting tips, and provide proven strategies to save money fast. Whether you’re a beginner or looking to refine your skills, you’ll leave with a personalized plan to achieve financial freedom. Let’s dive in!

Why Creating a Budget is Essential in 2025

A budget is more than just a financial tool—it’s a roadmap to control your money rather than letting it control you. In the USA, 60% of households live paycheck to paycheck, according to a 2024 Federal Reserve report, while in Canada, similar trends are noted by Statistics Canada. With inflation and housing costs on the rise, learning how to create a budget plan is critical to avoid debt and build savings.

- Benefits: Reduces financial stress, helps you save money, and prepares you for emergencies.

- Relevance: Timeless advice adaptable to economic shifts in both countries.

- Keyword Focus: “how to create a budget,” “save money”

This guide leverages insights from financial experts and real-world data to ensure you’re equipped with the best budgeting tips for long-term success.

Step-by-Step Guide to Create a Budget

Creating a budget doesn’t have to be overwhelming. Follow these detailed steps to craft a plan that fits your lifestyle, whether you’re in New York, Toronto, or elsewhere.

Step 1: Assess Your Income

- What to Do: Calculate your total monthly income after taxes. Include salary, freelance earnings, or side hustles like Uber driving or Etsy sales.

- Example: If you earn $3,000/month in the USA (net after taxes) and $200 from a side gig, your total income is $3,200.

- Tool: Check pay stubs or bank statements for accuracy.

- Keyword: “create a budget plan”

Step 2: List Your Expenses

- What to Do: Categorize all monthly expenses. Common categories include:

- Fixed Costs: Rent ($1,200), car payment ($300), insurance ($100).

- Variable Costs: Groceries ($400), utilities ($150), entertainment ($100).

- Discretionary Spending: Dining out ($50), subscriptions ($20).

- Tip: Track spending for 30 days using a notebook or app like Mint to identify leaks.

- Keyword: “budgeting tips”

Step 3: Choose a Budgeting Method

Select a method that suits your habits. Here are three popular options:

- 50/30/20 Rule: Allocate 50% to needs (e.g., rent, bills), 30% to wants (e.g., movies, shopping), and 20% to savings or debt.

- Example: With $3,200 income, $1,600 for needs, $960 for wants, $640 for savings.

- Zero-Based Budget: Assign every dollar until your income minus expenses equals zero.

- Example: $3,200 income – $2,800 expenses = $400 saved or invested.

- Envelope System: Use cash for categories like groceries to limit overspending.

- Example: Put $400 cash in a grocery envelope and stop when it’s gone.

- Keyword: “save money fast”

Step 4: Set Financial Goals

- What to Do: Define clear goals to stay motivated. Examples:

- Short-Term: Save $500 for an emergency fund in 3 months.

- Long-Term: Save $10,000 for a down payment in 2 years.

- Tip: Use the SMART framework—Specific, Measurable, Achievable, Relevant, Time-bound.

- Example: “Save $200/month for 6 months to build a $1,200 emergency fund.”

- Keyword: “how to create a budget”

Step 5: Monitor and Adjust

- What to Do: Review your budget weekly or monthly. Adjust for changes like a raise or unexpected medical bills.

- Tool: Use YNAB ($14.99/month) or a free Google Sheets template to track progress.

- Example: If utilities rise from $150 to $200, cut entertainment from $100 to $50.

- Keyword: “budgeting tips”

Proven Strategies to Save Money Fast

Saving money requires intentional actions. Implement these strategies to maximize your savings in 2025.

Cut Unnecessary Expenses

- Action: Cancel unused subscriptions (e.g., Hulu, gym memberships) and limit dining out to once a month.

- Case Study: A Canadian blogger saved $80/month by canceling three streaming services, redirecting it to a vacation fund.

- Saving Potential: $50–$150/month in the USA/Canada.

- Keyword: “save money”

Shop Smart

- Action: Use coupons from sites like RetailMeNot, buy in bulk at Costco, and compare prices online.

- Tip: Shop seasonal sales (e.g., Black Friday in the USA, Boxing Day in Canada) for big savings.

- Example: Switching to store brands saved a family $30/month on groceries.

- Keyword: “save money fast”

Build an Emergency Fund

- Action: Start with $500–$1,000, then aim for 3–6 months of expenses ($3,000–$6,000 for a $3,200 income).

- Benefit: Covers job loss or car repairs without debt.

- Example: A USA resident saved $600 in 4 months by cutting dining out.

- Keyword: “how to create a budget plan”

Reduce Utility Bills

- Action: Switch to LED bulbs, unplug electronics, or lower your thermostat by 2°C (3.6°F).

- Saving Potential: $20–$50/month, per Energy Star estimates.

- Example: A Toronto household saved $40/month by adjusting heating.

- Keyword: “budgeting tips”

Automate Savings

- Action: Set up automatic transfers to a savings account post-payday.

- Tip: Use apps like Wealthsimple (Canada) or Ally Bank (USA) for high-interest savings.

- Example: Automating $100/month grew a $1,200 fund in a year.

- Keyword: “save money fast”

Sample Budget Template

Here’s a sample budget for a $3,200 monthly income using the 50/30/20 rule:

| Category | Amount | Percentage |

|---|---|---|

| Needs (Rent, Bills) | $1,600 | 50% |

| Wants (Entertainment) | $960 | 30% |

| Savings/Debt | $640 | 20% |

Visual Suggestion: Include a chart here (e.g., a bar chart showing the 50/30/20 split) to enhance engagement. [Note: Since I can’t generate charts directly, describe it as a “bar chart with green, blue, and yellow bars representing needs, wants, and savings, respectively.”]

- Adjust: Modify based on your income and goals.

- Keyword: “create a budget plan”

Common Budgeting Mistakes to Avoid

Avoid these pitfalls to ensure your budget succeeds:

- Overestimating Income: Use net income, not gross (e.g., $4,000 gross vs. $3,200 net in the USA).

- Ignoring Small Expenses: Daily coffee ($5 x 20 days = $100/month) adds up.

- No Flexibility: Reserve 5–10% for unexpected costs.

- Not Reviewing: Failing to adjust monthly can derail your plan.

- Keyword: “save money”

Advanced Tools and Resources to Create a Budget

- Free Tools: Google Sheets (customizable templates), Excel, or Mint (free app).

- Paid Tools: YNAB ($14.99/month) for detailed tracking; PocketGuard ($4.99/month) for spending limits.

- Books: “The Total Money Makeover” by Dave Ramsey (USA-focused); “The Wealthy Barber” by David Chilton (Canada-friendly).

- Websites: NerdWallet for USA tips, Canadian Budget Binder for Canada-specific advice.

- Keyword: “how to create a budget”

How to Stick to Your Budget in 2025

Consistency is key. Try these habits to stay on track:

- Set Reminders: Use calendar alerts for bill due dates.

- Reward Yourself: Treat yourself to a $20 movie night after saving $200.

- Involve Family: Share budgeting tips with partners or roommates to align goals.

- Join Communities: Engage on Reddit’s r/personalfinance or Facebook budgeting groups.

- Keyword: “save money fast”

Real-Life Success Stories

- USA Case: A single parent in Texas saved $1,000 in 6 months by cutting cable TV and cooking at home, using the 50/30/20 rule.

- Canada Case: A Vancouver freelancer built a $2,000 emergency fund in 8 months by automating savings and shopping sales.

- Keyword: “budgeting tips”

Below is an SEO-optimized FAQ section tailored for the expanded blog post “How to Create a Budget and Save Money: A Step-by-Step Guide for 2025”. This section addresses common questions from beginners in the USA and Canada, incorporates long-tail keywords (e.g., “how to create a budget for beginners,” “save money tips 2025”), and aligns with the post’s focus on practical budgeting tips. The FAQs enhance user engagement, improve dwell time, and increase the chances of appearing in Google’s “People Also Ask” boxes or rich snippets when paired with schema markup. The content is informed by insights from search intent tools like AnswerThePublic and community discussions (e.g., Reddit’s r/personalfinance).

FAQ: How to Create a Budget and Save Money in 2025

This FAQ section answers the most common questions about creating a budget and saving money, tailored for beginners in the USA and Canada. Dive in to find clear, actionable solutions to manage your finances effectively.

1. What is a budget, and why should I create one as a beginner?

A budget is a plan that tracks your income and expenses to help you manage money. For beginners, creating a budget is essential because it:

- Prevents overspending and debt accumulation.

- Helps you save money for goals like an emergency fund or vacation.

- Builds financial habits early, critical in 2025’s economic climate.

- Keyword: “how to create a budget for beginners”

Example: A new grad earning $2,500/month can avoid debt by budgeting for rent and savings.

2. How do I create a budget with no experience?

Follow these simple steps to create a budget plan:

- Step 1: List your monthly income (e.g., $3,000 net salary).

- Step 2: Track expenses for 30 days using a notebook or Mint.

- Step 3: Choose a method like 50/30/20 (50% needs, 30% wants, 20% savings).

- Step 4: Set a small goal (e.g., $100 savings/month).

- Step 5: Review weekly and adjust.

- Keyword: “create a budget plan”

Tip: Start with a free tool like Google Sheets to keep it simple.

3. What are the best budgeting tips for saving money fast in 2025?

Try these proven save money tips:

- Cancel unused subscriptions (e.g., $10/month streaming).

- Shop sales at Costco or use coupons from RetailMeNot.

- Automate $50/month to savings with apps like Wealthsimple (Canada) or Ally (USA).

- Cook at home to cut dining costs by $50–$100/month.

- Keyword: “save money tips 2025”

Example: A Toronto resident saved $120/month by cooking and canceling services.

4. How much should I save each month?

- General Rule: Aim for 10–20% of your income (e.g., $300–$600 from $3,000).

- Emergency Fund: Start with $500–$1,000, then 3–6 months of expenses.

- Adjust: Base it on your goals (e.g., $200/month for a car down payment).

- Keyword: “save money”

Note: Adjust based on USA/Canada cost of living (e.g., higher in cities like Vancouver).

5. What tools can I use to create a budget?

- Free Tools: Google Sheets, Excel, Mint (tracks spending automatically).

- Paid Tools: YNAB ($14.99/month) for detailed planning; PocketGuard ($4.99/month) for limits.

- Apps: Wealthsimple (Canada) or Chime (USA) for savings goals.

- Keyword: “how to create a budget”

Recommendation: Start with Mint, then upgrade to YNAB as your income grows.

6. How long does it take to see results from budgeting?

- Short-Term: Notice reduced overspending in 1–2 months.

- Long-Term: Build a $1,000 emergency fund in 4–6 months with $200/month savings.

- Factors: Consistency and cutting expenses (e.g., $50/month on subscriptions).

- Keyword: “save money fast”

Example: A USA freelancer saved $800 in 5 months by tracking and adjusting.

7. Can I create a budget if my income varies?

Yes, use a flexible budget:

- Estimate Average Income: Average last 3 months (e.g., $2,000, $2,500, $2,200 = $2,233/month).

- Prioritize Needs: Cover rent and bills first.

- Adjust Weekly: Use extra income for savings or debt.

- Keyword: “budgeting tips”

Tool: YNAB excels at variable income tracking.

8. How do I stick to my budget in 2025?

- Set Reminders: Use phone alerts for bill payments.

- Reward Yourself: Treat yourself with $20 saved after a month.

- Track Daily: Check spending via apps or a journal.

- Get Support: Discuss with family or join r/personalfinance.

- Keyword: “save money tips 2025”

Tip: Celebrate small wins to stay motivated.

9. What if I can’t save money due to high expenses?

- Reduce Costs: Negotiate bills (e.g., internet) or switch providers.

- Increase Income: Take a side hustle (e.g., $200/month from tutoring).

- Prioritize: Cover essentials, then save even $10–$20/month.

- Keyword: “how to create a budget for beginners”

Example: A Canadian saved $30/month by switching phone plans.

10. How often should I update my budget?

- Monthly: Review after each pay cycle to adjust for changes.

- Quarterly: Update goals or methods (e.g., switch from 50/30/20 to zero-based).

- Annually: Reflect on 2025 financial progress and set new targets.

- Keyword: “budgeting tips”

Pro Tip: Use January 2026 to plan for the next year.

Final Thoughts

Mastering how to create a budget and save money is a life-changing skill, especially in 2025’s economic climate. This guide provides a step-by-step approach to craft a budget plan, implement budgeting tips, and save money fast, tailored for USA and Canada residents. Start with a simple budget, track your progress, and adjust as needed. With discipline, you’ll achieve financial freedom and peace of mind.

Ready to transform your finances? Download our sample budget template or try these steps this week. Share your progress or questions in the comments—we’d love to support you!

Last Updated: July 18, 2025, 10:23 AM IST

Sources: Federal Reserve (2024), Statistics Canada, NerdWallet, Canadian Budget Binder, Dave Ramsey.

Related Articles for Context

- BitChat: Revolutionizing Decentralized Messaging in 2025

- Tips to Get Hired Faster for Remote Jobs in 2025

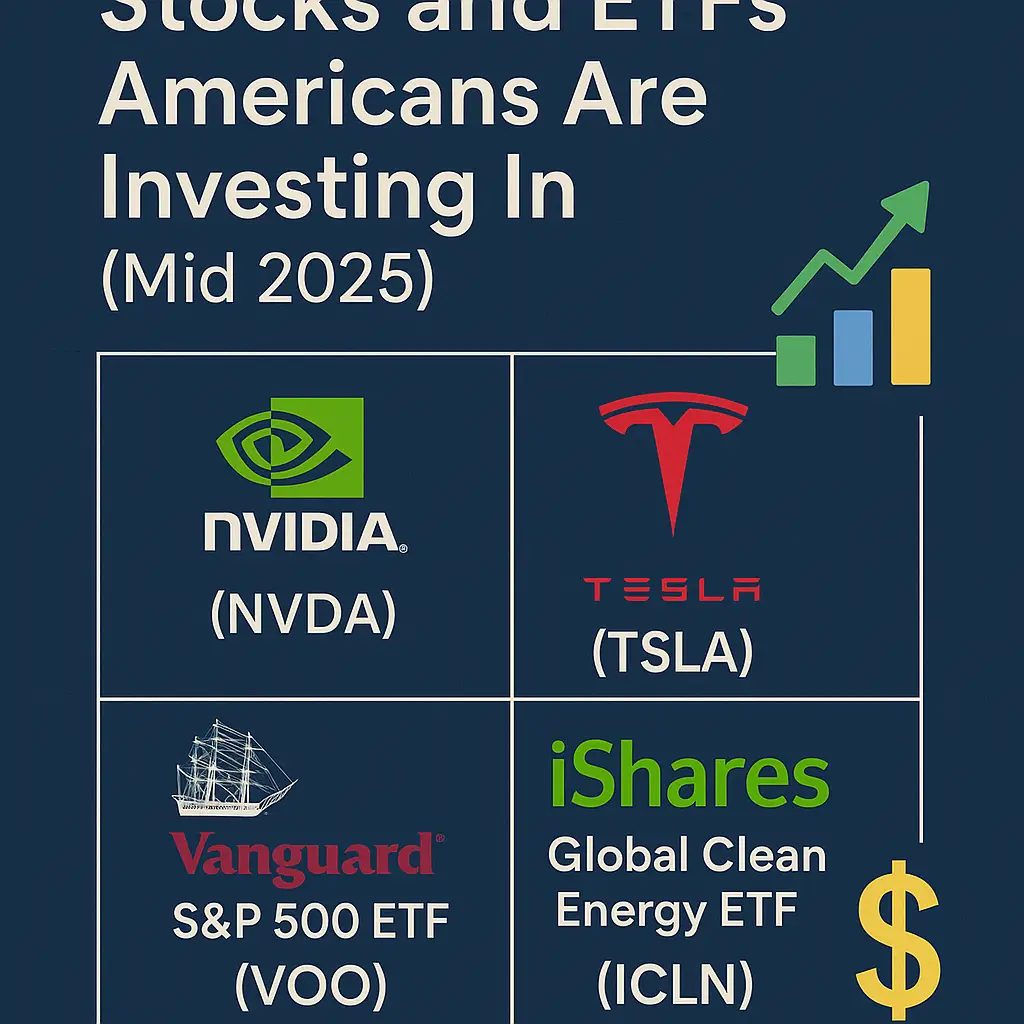

- Trending Stocks and ETFs Americans Are Investing In (Mid 2025)

- Netflix vs Disney+ vs Prime Video – Which Streaming Service Wins in 2025?

- 120 Profitable Blog Niche Ideas & How to Pick the Right One (2025 Guide)

- Top 5 Reasons XRP Could Surge in 2025

- ChatGPT vs Gemini vs Claude – Which AI Wins in 2025?

- Best Websites to Find Freelance Jobs in the USA (2025)

- Top US States Hiring the Most in 2025 (Jobs by Location)

- How to Get Free Subscriptions of Netflix, Prime Video & Disney+ in 2025 (Legally)

- Top 5 VPNs to Use in 2025 – Safest & Fastest for USA, UK & Canada