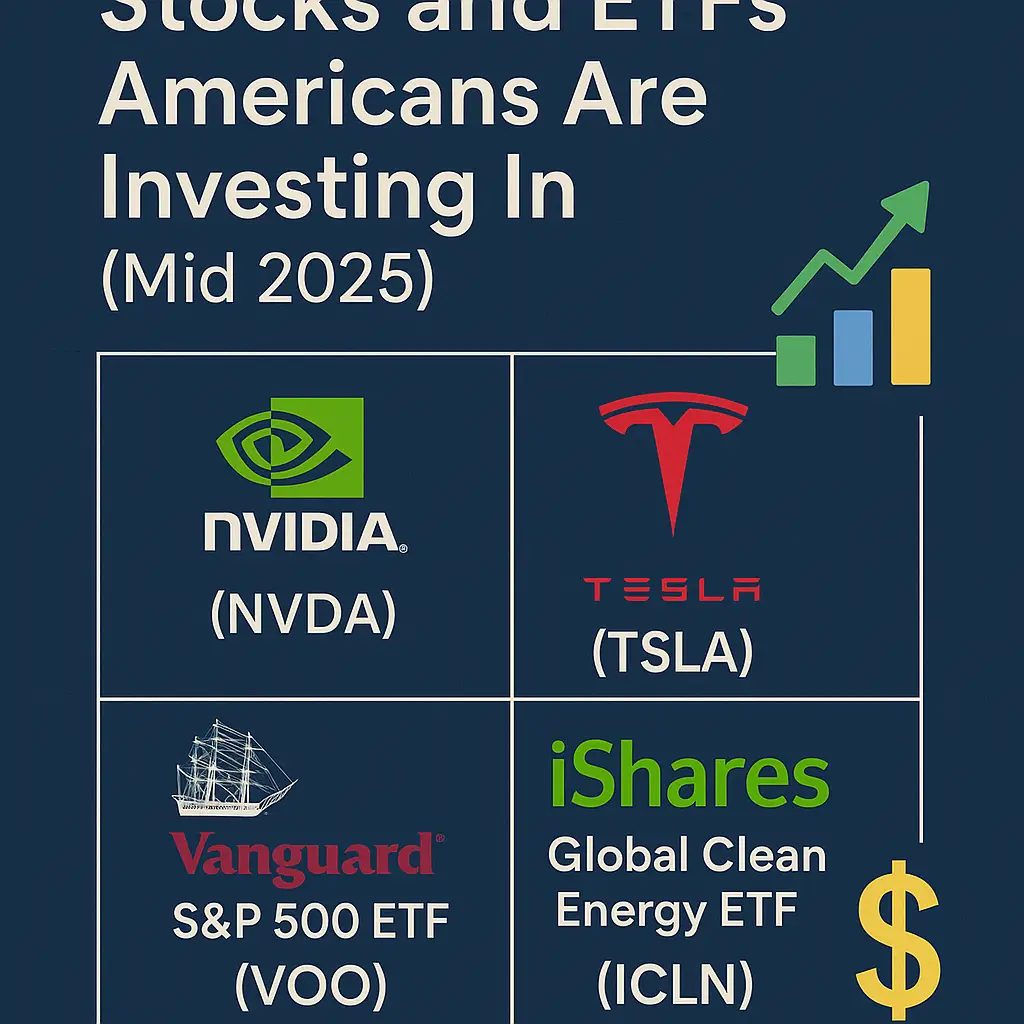

Trending Stocks and ETFs Americans Are Investing In (Mid 2025)

Discover the top stocks and ETFs Americans are investing in during mid-2025, including NVIDIA, Tesla, QQQ, JEPI, and clean energy picks like ICLN.

As we move into the second half of 2025, the U.S. stock market is riding a wave of innovation, AI transformation, and shifting economic priorities. From high-growth tech giants to sustainable energy firms and passive index ETFs, American investors are diversifying their portfolios like never before.

In this post, we’ll explore the top-trending U.S. stocks and ETFs Americans are investing in during mid-2025, what’s driving their popularity, and how smart investors are positioning themselves in today’s dynamic market.

1. NVIDIA (NVDA) – Still Leading the AI Boom

NVIDIA continues to dominate as the #1 stock pick in 2025 thanks to its central role in powering artificial intelligence hardware across the globe.

With the rapid adoption of AI chips, data centers, and edge computing, NVIDIA has seen strong quarterly earnings and expanded partnerships in defense, robotics, and healthcare AI.

🔥 Why It’s Trending:

- Surging demand for AI GPUs

- Record revenue growth in Q2 2025

- Strong long-term outlook for AI infrastructure

SEO Keywords: NVIDIA stock 2025, top AI stocks USA, best growth stock mid 2025

2. Palantir Technologies (PLTR) – Data-Driven Government & AI Growth

Palantir is one of the fastest-rising mid-cap stocks in 2025, thanks to its cutting-edge AI platforms for defense, finance, and public health.

With major U.S. government contracts and AI software expansion into Fortune 500 companies, Palantir is seen as both a data powerhouse and a speculative growth stock.

🔥 Why It’s Trending:

- AI-powered platforms gaining adoption

- Strong institutional investor interest

- Low debt and scalable business model

SEO Keywords: Palantir stock forecast USA, best AI software stocks, PLTR 2025 news

3. Tesla (TSLA) – EV & Energy Innovation Keeps It Hot

Tesla remains one of the most widely held stocks by U.S. investors, and it’s trending again in mid-2025 due to its push into autonomous driving, battery storage, and new factory expansions.

Its recent advancements in Full Self Driving (FSD) and energy storage partnerships have reignited bullish sentiment on Tesla’s long-term innovation potential.

🔥 Why It’s Trending:

- New energy storage revenue streams

- Growing EV adoption across North America

- AI-enabled autonomous software updates

SEO Keywords: Tesla stock prediction 2025, best EV stocks USA, TSLA growth outlook

4. Vanguard S&P 500 ETF (VOO) – The Safe Long-Term Bet

For Americans looking for stable, long-term returns, VOO remains a top choice. This ETF tracks the S&P 500 and offers diversified exposure to the top 500 U.S. companies.

With rising interest in passive investing, more retail and institutional investors are piling into VOO for long-term wealth building.

🔥 Why It’s Trending:

- Low-cost exposure to U.S. market

- High historical returns

- Safe bet during uncertain times

SEO Keywords: best index ETF USA 2025, VOO ETF review, long-term investing USA

5. iShares Global Clean Energy ETF (ICLN) – ESG & Green Investing

As climate change and green energy take center stage in U.S. politics and economics, ICLN has become one of the most traded ESG ETFs in 2025.

It offers access to top clean energy firms like NextEra Energy, Enphase, and Vestas.

🔥 Why It’s Trending:

- Government incentives for renewables

- ESG investing continues to grow

- Exposure to clean tech leaders globally

SEO Keywords: clean energy ETFs USA, ICLN 2025 performance, top ESG funds 2025

6. Invesco QQQ ETF – Tech Dominance in One Fund

QQQ, which tracks the Nasdaq-100, gives investors exposure to the largest U.S. tech companies like Apple, Microsoft, Amazon, and Meta.

In 2025, QQQ is trending again as tech rebounds and leads U.S. market gains thanks to AI, cloud, and automation tailwinds.

🔥 Why It’s Trending:

- Heavy tech exposure

- Outperformance in Q1 and Q2 2025

- Strong liquidity and daily trading volume

SEO Keywords: QQQ ETF forecast 2025, top tech ETFs USA, best ETFs to invest in 2025

7. JPMorgan Equity Premium Income ETF (JEPI) – Income + Stability

JEPI is gaining traction among retirees and conservative investors looking for steady income with less risk.

The ETF uses options strategies to generate monthly income, making it one of the top choices for dividend investors in 2025.

🔥 Why It’s Trending:

- Attractive yield above 7%

- Lower volatility than other equity ETFs

- Strong performance in sideways markets

SEO Keywords: JEPI ETF review 2025, best income ETF USA, monthly dividend stocks 2025

Expert Tips for Investing in 2025’s Trending Stocks & ETFs

- Diversify: Don’t put all your money in tech or AI—balance with energy, financials, or healthcare.

- Watch Earnings: Keep an eye on quarterly reports before buying trending stocks.

- Use ETFs for Safer Exposure: If you’re unsure about individual stocks, choose ETFs with diversified exposure.

- Avoid the Hype: Do your own research (DYOR) instead of chasing TikTok or Reddit trends.

What’s Hot in the U.S. Stock Market (Mid 2025)

Americans in 2025 are investing more intelligently than ever, using a mix of trending AI stocks, EV plays, clean energy funds, and reliable index ETFs to build long-term wealth.

Whether you’re just starting out or optimizing your portfolio, these top-trending stocks and ETFs offer a great mix of growth, safety, and innovation.

Always remember to invest according to your risk profile, stay informed, and keep your strategy long-term focused.

Trending stocks USA 2025

Best ETFs to invest in mid 2025

Top AI stocks USA 2025

Tesla and NVIDIA stock news 2025

Clean energy ETF USA 2025

VOO vs QQQ 2025

Safe investments in USA mid-2025Trending stocks USA 2025

Best ETFs to invest in mid 2025

Top AI stocks USA 2025

Tesla and NVIDIA stock news 2025

Clean energy ETF USA 2025

VOO vs QQQ 2025

Safe investments in USA mid-2025

Pingback: ChatGPT vs Gemini vs Claude – Which AI Wins in 2025? - CGViral - Trending Tech, Money & Investment Guides (2025)

Pingback: BitChat: Revolutionizing Decentralized Messaging in 2025 - CGViral - Trending Tech, Money & Investment Guides (2025)

Pingback: 120 Profitable Blog Niche Ideas & How to Pick the Right One (2025 Guide) - CGViral - Trending Tech, Money & Investment Guides (2025)

Pingback: How to Create a Budget and Save Money: A Step-by-Step Guide for 2025 - CGViral - Trending Tech, Money & Investment Guides (2025)

Pingback: क्यों है Origin LGNS क्रिप्टो की दुनिया में चर्चा का विषय? - SarkariSeva.in – हर योजना की पूरी जानकारी

Pingback: How Origin LGNS Powers the Origin Ecosystem: Use Cases & Utility Explained - CGViral - Trending Tech, Money & Investment Guides (2025)