SBI Fixed Deposit vs SIP in 2025 – Which is Better for Your Investment?

SBI Fixed Deposit vs SIP in 2025 – Full Comparison Guide

Confused between SBI Fixed Deposit and SIP? Explore the pros, cons, returns, risk, and tax implications of FD vs SIP in 2025 to make the right investment choice.

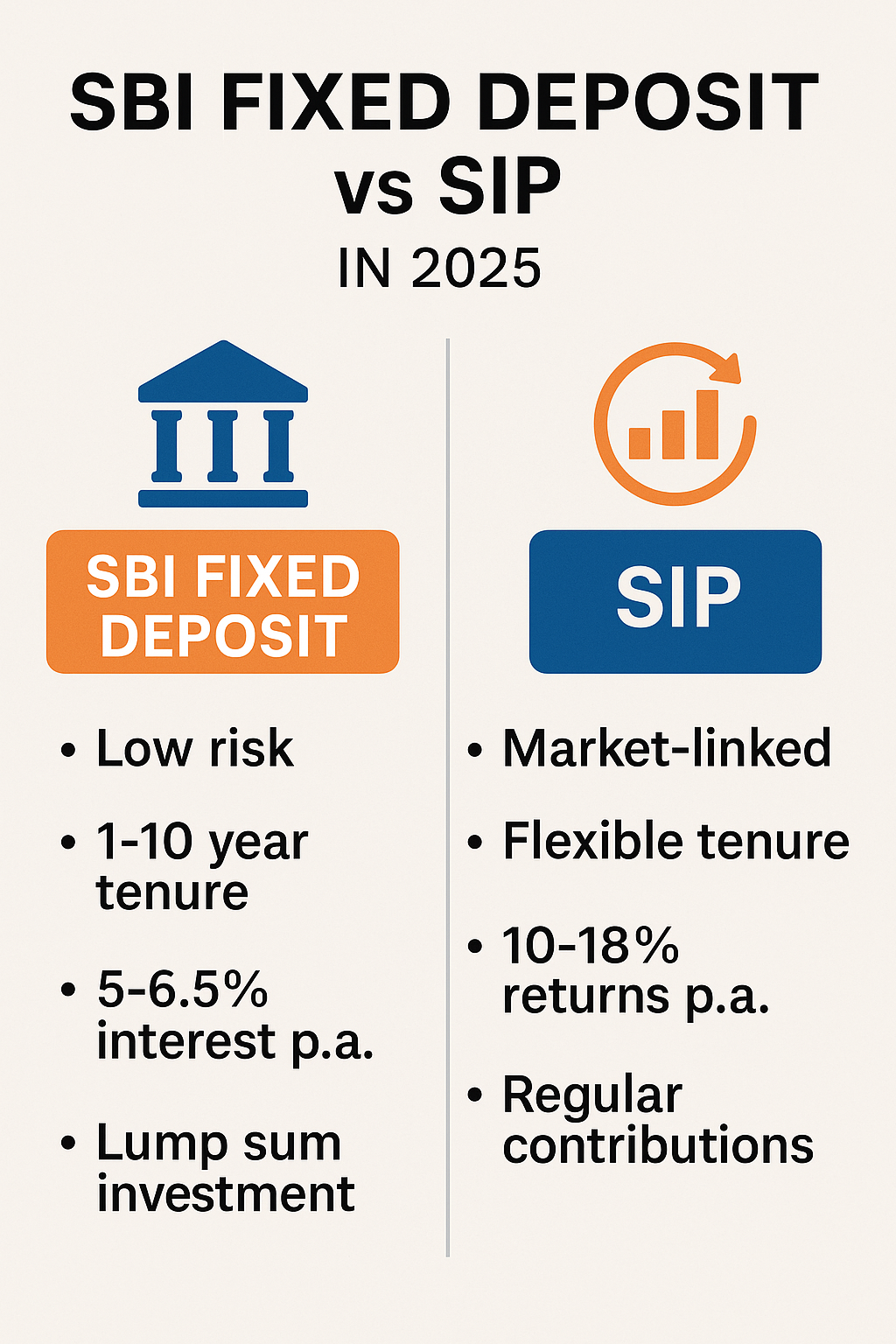

Choosing the right investment option can be confusing — especially when comparing two of the most popular choices: SBI Fixed Deposit (FD) and Systematic Investment Plan (SIP) in mutual funds.

While one is a traditional low-risk savings tool, the other is a modern market-linked wealth-building strategy. In this blog, we compare SBI FD vs SIP in 2025 to help you decide which suits your financial goals better.

What is an SBI Fixed Deposit (FD)?

An SBI Fixed Deposit allows you to deposit a lump sum amount for a fixed tenure at a predetermined interest rate. You earn assured returns with zero market risk.

Key Features:

- Tenure: 7 days to 10 years

- Interest Rate (2025): 6.5% – 7.10% (as per tenure & senior citizen status)

- Capital Protection: 100% guaranteed

- Risk: Low to Zero

What is a SIP (Systematic Investment Plan)?

A SIP allows you to invest a fixed amount periodically (monthly/quarterly) into a mutual fund scheme, often equity-based. It benefits from market growth and compounding over time.

Key Features:

- Investment starts from ₹500/month

- Returns depend on mutual fund type (equity, hybrid, debt)

- Risk: Medium to High, but managed

- Returns (historical average): 10% – 15% annually

SBI FD vs SIP: A Side-by-Side Comparison

| Feature | SBI Fixed Deposit | SIP (in Mutual Funds) |

|---|---|---|

| Return Rate | 6.5% – 7.10% p.a. | 10% – 15% p.a. (equity funds) |

| Risk Level | Low | Medium to High |

| Liquidity | Medium (penalty on premature) | High (can redeem anytime) |

| Taxation | Interest taxed as per slab | LTCG @10% after ₹1L (Equity) |

| Compounding | Fixed interval | Market-driven, compounding |

| Investment Mode | Lump sum | Monthly or SIP-based |

| Ideal For | Risk-averse, retirees | Long-term wealth creators |

Pros and Cons

SBI Fixed Deposit

Pros:

- Assured returns

- Safe and regulated by RBI

- Easy to open and manage via SBI app or net banking

Cons:

- Low post-tax returns

- Penalization on premature withdrawal

- No inflation-beating growth

SIP (Mutual Funds)

Pros:

- Potential for higher returns

- Rupee-cost averaging and compounding

- Flexible and automated investment

Cons:

- Subject to market risk

- Fund selection and timing impact returns

- Requires longer-term horizon (3–5+ years)

Tax Implications

- FD: Interest is fully taxable as per your income tax slab. No indexation benefit.

- SIP:

- Equity Funds: LTCG tax @10% after ₹1L profit in a year

- Debt Funds: Taxed as per holding period and slab

Who Should Choose SBI FD?

- Retirees or senior citizens looking for capital safety

- Short-term goals (1–3 years)

- Individuals in high-risk-averse category

- People without internet/mobile banking comfort

Who Should Choose SIP?

- Young professionals with long investment horizons

- Investors aiming to beat inflation and grow wealth

- People comfortable with digital investing and market volatility

- Tax-conscious savers wanting smarter returns

Expert Recommendation

Balanced investors often choose both:

- Use SBI FD for emergency or short-term funds

- Invest via SIP for long-term wealth accumulation (retirement, education, buying a house)

Diversifying between the two reduces overall risk and keeps your portfolio aligned with goals.

Both SBI Fixed Deposits and SIPs offer unique advantages. If your priority is safety and stability, go with SBI FD. If you’re focused on long-term wealth and can tolerate some market ups and downs, SIP is your best bet.

Evaluate your financial goals, risk tolerance, and investment horizon before making a decision.

Still confused between FD and SIP? Drop your queries in the comments or contact us for a personalized investment strategy.